Episode 13: Corporate Finance and Angel Investing Ft. Jeff DeBoer

Jeff DeBoer has had a diversified career in finance. From a financial analyst in Japan covering Japanese chemical companies, to dealing with credit lines for Fuji Bank, to Chief Financial Officer of an automotive retailer, to now an angel investor, Jeff has had great experience in the realm of finance. He sat both on sides of the investment table; he dug deep into companies during his career as a financial analyst and during his time as CFO dealt with investors during the financial crisis. Our conversation dives into what he has learned and what he has been up to recently as an angle investor. Jeff runs one of his angle investments Funagain Games, where we uncover the world of board games and their value in today’s world.

This was my last episode on KCR College Radio at San Diego State but no worries, I’ll be continuing to come out with more episodes from time to time, got any suggestions for episodes? Email alleywayinvesting@gmail.com for questions, comments, or investment inquiries.

Episode 12: Astronomy Edition Ft. Professor Leonard

Professor Leonard is a PhD astronomer who is a professor of astronomy at San Diego State University, he has also made numerous appearances in science and astronomy related documentaries on T.V. I took his introductory course in astronomy my freshman year and learned a ton, and showed how astronomers study spectrographs and analyze data to study and learn more about the heavens. It sounds pretty familiar to a profession this show talks about: financial analyst (aside from the heavens and replacing spectrographs with charts). Finance and astronomy actually complement each other well believe it or not. The whole universe of space and the universe of stocks are both a lot to grasp, they both analyze data for findings and meaning, and they both tend to use complex algorithms. Our conversation dives into how Professor Leonard got into astronomy, and the keys to be a successful astronomer (or financial analyst?).

Topics Discussed: Currencies, Larry Summers, Astronomy

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Also check out a stream or cast of Berkshire Hathaway’s shareholders meeting this weekend! Here’s an analysis from the WSJ.

Episode 11: Grant Writing and Investment Philosophy Ft. Professor Fielden

This episode I bring on Professor Fielden, a professor in the rhetoric and writing school at San Diego State University on to talk about grant writing and investment philosophy. While we do have a short conversation it cannot be emphasized enough how important portraying investment philosophy is in investing. By explaining your style, technique, and how you execute your investments in a simple fashion, it can be quite powerful for others to listen and follow.

We also talk about Professor Fielden’s expertise in grant writing. Professor Fielden has written numerous grants for the California State University system along with community colleges in the San Diego area. (Our conversation begins at around 37:00)

Topics Discussed: Canada, Paradox of Choice, Blockchain, Grant Writing, Business Writing

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Click here to check out my update on my interest rate investment project.

Episode 10: Gaming and Computers in Finance Ft. Tyler Hale

This episode is packed with some great topics. Tyler Hale from Santa Rosa, California is a computer science major here at San Diego State University and is a roommate of mine (the other roommate was in the pilot episode scroll all the way down to listen). We talk about the gaming industry and in particular computer gaming (vs. consul gaming). We dive into security rights and hacking as well as how computers have effected the financial industry. It may seem that the two industries are opposites in culture, but in actuality both are heavily reliant on each other. (Tech industry needs credit from financial institutions, finance industry needs technology innovations from Silicon Valley)

Click here to double check your income taxes! Scroll down to the interactive tax chart and see how much you should be paying.

Topics Discussed: Taxes, Capital Gains Tax, Computer Gaming, High Frequency Trading, Security

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Episode 9: Athlete-Student Edition Ft. Jacob Goldberg & Justin Kelly

This episode is ran a little differently. Where I typically have financial guests on the show, this time I have some athlete-students on to talk about their lives balancing athletics and school along with teasing out some of their successful habits and their day-to-day routines. There can be a lot to learn and relate to business or multiple professions in this episode if you treat their sports as analogies to the work-life balance instead of school-athletic (or another analogy you may think of). Jacob Goldberg I’ve met through a mutual friend where we’ve been running an investment (ad)venture with for the last couple months. Jacob Goldberg runs track and field at Oklahoma University and is a finance major in the Price College of Business. You can catch his bio and accomplishments here. Justin Kelly is an athlete-student from Chicago and I’ve known Justin as a high school friend. Justin plays baseball at Wayne State University in Detroit, MI and majors in business management. You can check out his accomplishments and stats here.

I asked some similar questions to both and came up with a profound conclusion with conversations with both guests: (you may find different conclusions)

Both athletes attest to strict schedule and prioritize their times to where they deem fit. This rigorous time management helps them balance and get their goals done. And when I mean rigorous, Justin sometimes does it down to the minute.

Topics Discussed: Athletics, Baseball, Track & Field, Time Management

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Episode 8: International Investing Part 2 Ft. Meb Faber

Meb Faber is the Co-Founder and Chief Investment Officer at Cambria Investment Management. Meb has numerous white papers and five books, one that I am a fan of is The Ivy Portfolio which dives into how the endowments like Yale’s have had monstrous performances in the past years and their strategies. His work has been featured in Barron’s, The New York Times, and The New Yorker. You can check out his 5 books here, along with his research website here. To check out Cambria Investment Management click here.

Topics discussed this week to conclude my segments on international investing: Valeant Pharmaceuticals, Yahoo, and Buffet’s hypocritical stance on hedge funds among other topics discussed.

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Episode 7: International Investing Part 1 Ft. Shigeki “Shagg” Makino

Shagg Makino is a retired global equity-investment professional. He has done stints at Putnam Investments as a Managing Director & Head of Global Large Capitalization Equities & Fidelity Investments as Director of Research and Portfolio Manager. He has spent time living in Chicago, Boston, London, Tokyo, Barcelona, Hong Kong, Tokyo, Chiang Mia, Thailand and has traveled to many other places. He has been a guest lecturer at Cornell University and serves on the board of multiple companies. Needless to say Shagg has a lot of experience investing internationally. Our discussion goes into what skills analysts should have the fundamental metrics used to analyze international equities, how he got started in the investing industry, and, oh yeah, he also runs really really fast. Shagg has ran for the USA Track & Field World Masters Indoor Championship. We go into helping athletes (or non-athletes) try to run faster and quick tips into improving your speed.

Topics Discussed: MSCI Index, Emerging Markets, International Investing, Track & Field

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Episode 6: Active Investing Ft. Wesley Gray

Wes Gray is an author, portfolio manager, and veteran of the U.S. Marine Corp. He is the CEO and founder of Alpha Architects outside of Philadelphia. Alpha Architects is an asset management firm that powers investors through education. As asset management firms go, Alpha Architects is as transparent as it gets. He and his team of PhD financial “quants” release tons of great research, tools, and books that help investors and clients understand the realm of value investing, quantitative investing (scroll down to where I talk about “quants” in episode 3). More specifically, Wes and I talk about a recent blog post titled “Even God Would Get Fired as an Active Manager“.

Topics Discussed: Active Investing, Passive Investing, Vanguard 500

Here are a list of books to look through from Alpha Architects

Here is their blog with some more insightful and well-written posts

Got any requests? Email alleywayinvesting@gmail.com with questions, comments, concerns. They are all welcome!

Episode 5: The Psychology of Trading Ft. Deborah Morris

Deborah Morris (yes we are related) is the director of the Institute for Marriage and Family Counseling and is a licensed clinical counselor with an extensive background in marriage and family counseling. She is also an amateur at home trader who has done quite well over the last two months while the market has been producing negative returns. She discusses her strategy on how she plays the emotions of the markets by investing in Proshares ETFs (primarily UVXY). This tracks the daily movements of the VIX (Volatility) Index, also known as the fear index. Keep in mind that the particular investment she mentioned is leveraged, and also is a very short term investment (usually only a day or two). Also a little disclosure, while Deborah is a licensed clinical counselor she is an AMATEUR trader and by no means has professional certifications as an investment professional. We discuss topics like investing in group dynamics, mental illness on wall street, investment techniques, and much more.

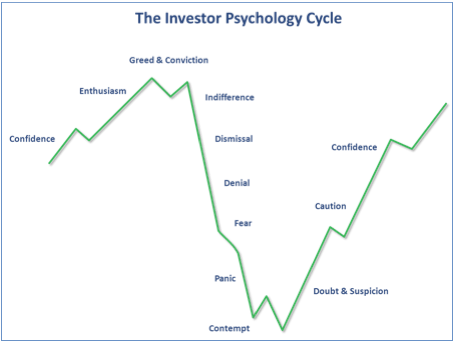

Here’s a chart that perfectly explains the psychology of trading and emotions in the market, these types of feelings while natural, if avoided can help shape investor’s disciplines.

Episode 4: Financial Crises and Economic Trading Ft. Dr. James Gerber

Dr. Gerber is an economics professor at San Diego State University and studies Latin American economies and U.S. – Mexico relations. He has served as the Director of the Center for Latin American Studies at San Diego State University. He has also directed one of San Diego State’s top programs the International Business Program from 2009-2012. He is teaching this semester a class on financial crises and their economic impact. We also discuss economic trading and discuss America’s trading partners. This episode is full of great books and insights into our economic trading, some insights into financial crises, and top economists to search and read into. I always enjoy Professor Gerber’s office hours and look forward to taking a class with him. I also talk about where to get financial news and why reading it is important.

Here is his home page and he also has done a TedX talk about U.S. and Mexico boarder relations click here to watch.

Topics Discussed: Financial News Outlets, Financial Crises, Economic Trading

Episode 3: Asset Allocation Ft. Tom Anichini

This episode I had a friend of mine investment professional Tom Anichini on to talk about asset allocation, modern portfolio theory, and a glimpse into investment “quants”. Tom is Vice President and Senior Investment Strategist at Guided Choice. He has over 20 years of investment experience including a over a decade as a quantitative portfolio manager. He is an expert in portfolio construction and asset allocation and has been recently published in the Journal of Retirement with a paper titled Mean-Variance Analysis in Post-Retirement Planning with Ganlin Xu (check out his paper here). He also runs Portfolio Wizards and has some cool investment calculators and data sources on the website.

Topics Discussed: Warren Buffet, Berkshire Hathaway, Asset Allocation, Modern Portfolio Theory

To access Warren Buffet’s holdings click here and to access Berkshire Hathaway’s annual shareholder letters click here.

Episode 2: Household Economics Ft. Professor Grossbard

Professor Grossbard is an academic economist at San Diego State University. She specializes in the subfield of household economics – she applies the same econometric models and tools that are usually used for firms, for households. By treating the household as a non-profit firm, she uses empirical data to analyze the household and has come out with some pretty interesting studies. Her work coincides with labor economics, health economics, along with marriage economics. She is the founding editor of Review of Economics and Household and is considered a pioneer of economics of the household, so go check her out. Her full bio with book lists, research publications, and where to find her on the interweb and social media is here.

Topics Discussed: Tesla, Interest Rates, Household Economics

Episode 1: Pilot Feat. Devin Udasco

The very first episode of Finance Talk mistakes were made, but practice makes perfect. I was even skittish at times but hey first show went in the books. Devin Udasco is a second-year San Diego State business and honors student majoring in Management Information Systems. He is a buddy of mine who I constantly bump heads with regarding investing, sports, (pretty much anything) and we are both apart of Venture Group at San Diego State University a collaborative investment group investing in the equity and derivative market places. Topics discussed: Oil, Google, Chipotle, Interest Rates, and of course, Martin Shkreli.