Introduction

This is a second semester financial project through interactive brokers class in portfolio management and security analysis with professor Marie-Eve Lachance of San Diego State University. The project was given out as a typical weighted 30 stock portfolio where the inspiration came from Motif Investing. Being familiar with Motif Investing helped me conceptualize the purpose and inspiration that was an intended learning target by professor Lachance. The learning target was to customize weighting for a 30 stock portfolio, trade the stocks in interactive brokers over a horizon of 2 months, and report back to the class over a risk adjusted weighted average. The competition was against the risk-adjusted return, benchmark of the S&P 500, as well as the students within the class.

I diverted from the primary objective of the project and experimented with a different investment structure. I quite simply felt a 30 stock portfolio was too time consuming (This project was assigned and involved in Professor Lachance’s portfolio management and security analysis class, an M.B.A class and as an undergraduate first year I did not simply have enough time allocation to develop a 30 stock portfolio strategy). I also felt the 30 stock portfolio was too diversified, and in order to achieve maximum profit with the amount of time invested, I would concentrate my portfolio structure.

The capital for the project was provided by interactive broker’s paper money account of $1,000,000. The horizon was approximately between February 13th, 2015 and April 13th 2015. Although I had familiarity with Motif Investing I did not use the interface as inspiration for my investment strategy. But instead assessed the economic conditions and the horizon that contributed greatly to my investment strategy. I figured an investment strategy that was heavily concentrated and was allocated simply. This strategy was thought upon because of my time allocation to the project, the horizon of the project, and the economic conditions of the horizon.

Strategy

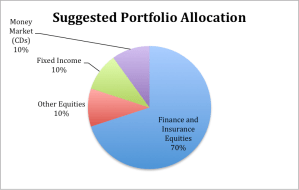

The strategy contained a heavy concentration of 6 allocated investment vehicles. The 6 securities were chosen based on pure percentages. The allocation went as follows:

50% Investment Vehicle

25% Investment Vehicle

11.3% ETF or Investment Vehicle

5% Low Risk Management

5% High Risk Management

3.7% Money Market (Cash)

This completely different investment structure goes against the 30 stock portfolio that was mentioned by Professor Lachance in class, but instead fits my primary objectives and time allocation. The primary objective of this structure made it easier for me to research for security selection, as well as increased my probability to obtain a maximum profit, the economic conditions I concluded felt suitable for this strategy during the duration of the horizon.

What was not foreseen was the risk-adjusted average at the end of the competition. I assessed the primary objectives and my personal time allocation wisely, but foresaw the risk-adjusted return that is weighted in at the end of the competition. Because of my concentrated investment strategy pursued maximum profit, it depending on the security selection, also obtained a higher than average risk.

Purpose

The purpose of this strategy was to maximize profit with my time allocation I put forth to the project. I bear in mind with a more substantial investment of my time this strategy would have been scrutinized, analyzed, and thought over more carefully and would have been altered. I was quite pleased with how this strategy worked out and with minor exceptions and mistakes with the time I put forth I felt as if this strategy achieved the purpose. I obviously altered the guidelines to the project that tailored to my primary objectives and time allocation. I have also presented the purpose of this paper to provide clarity to my investment project and give my track record out to public domain. I also acknowledge that this project was done with virtual money, which does not factor in certain incentives and psychological effects that is dealt with managing meaningful currency. Although I tend to find managing virtual money and actual money indifferent in a perfect scenario, since psychological effects should be minimized and incentives should be maintained.

Security Analysis

This section I will provide clarity to the security selection process as well as my holdings throughout this project. Keep in mind I will not be providing the percentages of the portfolio in which each security held, but instead will provide a list of the securities. The following list contains the securities that were held throughout this project.

ABX Barricks Gold Corp.

BKS Barnes N Noble

BRK B Berkshire Hathaway

COST Cosco

DG Dollar General

FINL Finish Line

GME Game Stop

GREK Greek 20 (ETF)

HABT Habit Restaurants

HAL Halliburton

HIBB Hibbert Sports

JACK Jack n the Box

KEYS Keysight Technologies

LULU Lululemon Athletica

M Macy’s

PZA Powershares Municipal Bond (ETF)

RES RPC Inc.

SWKS Skyworks Inc.

UA Under Armor

WTW Weight Watchers

The first acknowledgment that will be made upon the list will be the fact that there are well more than 6 securities listed. The structure that was created made it easily movable to go from one security to another. The way these securities were chosen were based off of multiple factors. One major investment style that contributed to this security selection was the combination of current events as well as quarterly earnings. Another investment style that resulted in this security selection was another combination of fundamental analysis and Benjamin Graham’s value investing. I used the same intuition that was in Benjamin Graham’sSecurity Analysis and historical pricing measurements. The movements between securities were based on the event driven investment style and were mostly the top 3 major holdings (50%, 25%, and 11.3% respectively). While the bottom 3 minor holdings (5%, 5%, and 3.7%) were traded lighter. The movements between holdings were on a daily and weekly basis again based on event driven investment techniques.

Data Analysis

The following section will analyze the data on a basis of trade volume throughout the portfolio to analyze and back selected security movement. Because of the high trade volume that incurred throughout the 2-month horizon, each trade will not be analyzed. The following data is provided through the first week of trading: February 13th – February 20th

Symbol S/T R S/T UN Loss Total Total

| ABX |

3,952.47 |

19,110.69 |

0.00 |

19,110.69 |

23,063.16 |

| GREK |

0.00 |

14,867.00 |

0.00 |

14,867.00 |

14,867.00 |

| HAL |

0.00 |

544.26 |

0.00 |

544.26 |

544.26 |

| JACK |

46,229.56 |

0.00 |

0.00 |

0.00 |

46,229.56 |

| PZA |

0.00 |

0.00 |

-103.00 |

-103.00 |

-103.00 |

| SWKS |

0.00 |

1,292.00 |

0.00 |

1,292.00 |

1,292.00 |

| Total |

50,182.03 |

35,813.95 |

-103.00 |

35,710.94 |

85,892.98 |

Data shows returns (realized and unrealized) and losses.

Over the first week of trading after I readjusted my securities to fit in the weights of the portfolio structure, I was pleased to find a successful time weighted rate of return of 7.42%. According to historical prices list of the S&P 500 the index gained 1% during the week (Yahoo Finance). As a majority of the equities traded were based off of event driven quarterly earnings, outliers were present in my security selection. For instance, Barricks Gold Corp. (Ticker: ABX) was held as one of my significant holdings at the beginning of the project but then was reduced to an slightly minor holding. Barricks Gold Corp. was chosen as a way to invest in the commodity gold. The company has posted negative earnings per share (which Graham would have frowned upon me taking a position in) but I went against Graham’s teachings in an investment in higher gold prices, plus a main weakness in Barricks Gold Corp. was their long standing debt, which is not owed for another 3 years, making the stock an ideal short term candidate to invest in for a gold position. Although going against Graham’s judgment may have paid off over the first week or so period of the project, Graham prevailed as gold prices turned. Again according to Yahoo Finance, Barricks Gold Corp. slid 7.4% during my duration of investment (which will be seen in later data sets). Although a profit was made on the holding when I reduced ABX to a minor holding of the portfolio, and realized profit was gained on the security during the weight shift. The weights of the securities in my portfolio were estimated and the exact weighting could have fluctuated during the investment period.

| JACK |

46,229.56 |

0.00 |

0.00 |

0.00 |

46,229.56 |

Although within my security selection process, there were outliers that performed exceedingly well. Jack in the Box was bought a day before earnings and held a significant weight in my portfolio. I spotted news articles of expansion in sales and with stores. Along with declining McDonald’s revenue, Jack in the Box was poised to steal the market share away. Which was the intuition behind the Jack in the Box trade.

The next data set will be presented from the dates between February 20thto March 6th. The roughly 2 weeks of trading that took place saw mixed results. Although the overall portfolio fell and cut into the earnings significantly, with a time weighted return of -3.59%. Compared with the S&P 500 average of -1.25% during the same time period (Yahoo Finance).

| ABX |

0.00 |

-12,118.26 |

-12,118.26 |

0.00 |

0.00 |

-12,118.26 |

| BKS |

0.00 |

0.00 |

0.00 |

-473.40 |

3,874.07 |

3,874.07 |

| COST |

0.00 |

0.00 |

0.00 |

0.00 |

494.92 |

494.92 |

| GREK |

10,863.50 |

0.00 |

10,863.50 |

0.00 |

0.00 |

10,863.50 |

| HAL |

0.00 |

-874.09 |

-874.09 |

0.00 |

0.00 |

-874.09 |

| M |

0.00 |

-15,219.06 |

-15,219.06 |

0.00 |

0.00 |

-15,219.06 |

| PZA |

0.00 |

0.00 |

0.00 |

-250.86 |

-250.86 |

-250.86 |

| RES |

0.00 |

0.00 |

0.00 |

-2,882.25 |

-2,882.25 |

-2,882.25 |

| SWKS |

0.00 |

0.00 |

0.00 |

0.00 |

5,213.60 |

5,213.60 |

| WTW |

0.00 |

-6,817.16 |

-6,817.16 |

0.00 |

0.00 |

-6,817.16 |

| Total |

10,863.50 |

-35,028.57 |

-24,165.07 |

-3,606.51 |

6,449.48 |

-17,715.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S/T R S/T Loss Total Loss Total Total

In an explanation of the data, the realized profit was $10,863.50 while realized losses were $35,028.57. The total first column shows realized losses, the total second column shows unrealized gains, and the final total column is the result of unrealized and realized profit (losses). These two weeks of trading highlighted benefits as well as problems with the structure I set up for the portfolio. Since securities are moved on roughly a daily to weekly basis, constant decision making into investments of large proportions being made. To point out, Macy’s was an example of this decision-making format based off of event driven and intuition. I bought Macy’s on the eve of its earnings report, expecting it to beat a heavily negative analyzed earnings report. A consumer list was presented with expected earnings adjustments leading up to Macy’s earnings report, and out of the each consumer company, Macy’s earnings expected to be hit the most. I realized this added risk into my investment decision in hopes of a positive surprise in earnings reactions. This was not the case, Macy’s may have beat in revenue, but sited a weaker outlook and currency issues to come. Currency issues will be cited in the economic conditions report.

Before leaving this data set I do want to remind the reader of a positive trade that involved an ETF tracking the Athens Stock Exchange and essentially was to me a great way to trade Greece news. The timing of the trades was based on news reports of a Greek bailout that was flooding financial media outlets. Instead of trading a direct source of a Greek bailout, which would be considered the Bank of Athens which reacted more strongly on the news of the Greece elections and bailout, I chose to follow the Athens Stock Exchange based on the reasoning of diversity the Athens Stock Exchange carried, essentially lowering risk on an already risky topic. This trade carried important timing to it because of how volatile the situation was and still currently is, although with the Greece elections and optimism in the air, I felt an opportunity to capitalize.

A Cold March

I will not be presenting the data for the rest of March but will summarize the performance and investing mistakes that were made. From March 2nd to March 31st my portfolio lost 5.27%. Still overall presenting a gain of 2.26%, the month of March presented a challenge and I found through data analysis, my investment mistakes made. In a comparison, the S&P 500 lost 1.77% during the same period (Yahoo Finance). This month foresaw the fall of the gold prices, and realized the loses I endured taking up an investment in Barricks Gold Corp. Barricks Gold Corp. lost 16% in the month of March, and with the portfolio structure that I created, a concentrated amount of the portfolio was critically hit by this security. Thankfully, there were some trades that cushioned the losses that the month of March endured. I will present more in my acknowledgments section of what I have learned from this month of trading.

The following data piece will end our data analysis. The following positions were held from March 31st to April 13th the end of the project date.

| BRK B |

0.00 |

-275.18 |

-275.18 |

| FINL |

8,509.67 |

0.00 |

8,509.67 |

| KEYS |

0.00 |

-2,500.22 |

-2,500.22 |

| LULU |

2,591.83 |

0.00 |

2,591.83 |

| RES |

6,677.07 |

0.00 |

6,677.07 |

| UA |

9,816.22 |

0.00 |

9,816.22 |

| Total |

27,594.79 |

-2,775.41 |

24,819.39 |

S/T Profit S/T Loss Total

All Profits/Losses are realized at the end of the project date (April 13th). The last remaining 2 weeks were able to recover from some of the losses endured in March and through the first half of April a time weighted return was 2.85% for the portfolio. This period was abnormal in the sense the activity or movement of positions was relatively light. Since the money market (cash) positions fluctuated during this period, less risk was taken throughout the portfolio and larger more consistent profits were taken.

Economic Conditions

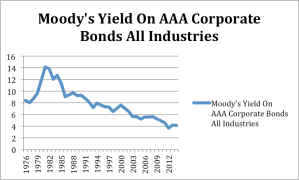

Economic conditions were carefully monitored throughout this project from a majorly macroeconomic standpoint. As this earnings period was summarized by the quote “stocks will have to earn their way now.” Stating the easy money by the Federal Reserve’s quantitative easing program was fully gone, and interest rate scares were flaring and continue to be a hot topic for the next few quarters.

Although a jobs report in March was reported well below the expectations, causing questions to be raised regarding the state of the economy. Janet Yellen the chairwomen of the Federal Reserve removed the key word ‘patience’ from Federal Reserve minutes causing questions in an interest rate hike, although with the economic data that they are heavily monitoring coming in more cautious than expected in March, a hard look will be taken on whether a hike will be coming in Q4 or Q1 of 2016.

A key economic factor that caused a more cautious earnings season was caused on the volatility of the oil and currency markets. Multinational companies were hit on currency rates volatility and the strengthened dollar. The volatile oil sector (which I tried to play) did not contribute to economic gains as I expected, especially in the consumer industry. Many corporations primarily blamed the currency fluctuations to poor earnings.

In a conclusion of primarily macroeconomic conditions, the equity market was a preferred asset class to invest in during this project based on small economic growth, and a cautious Federal Reserve based on international markets with the oil industry, and volatile currencies being barriers to higher returns.

Acknowledgments

In this section I will go over my mistakes and accuracies during this project and learn from both. I will not be going over every mistake extensively, but instead through the analysis portion I will be summarizing common characteristics found throughout my mistakes as well as accuracies.

Mistakes

Barricks Gold Corp. was an investment mistake in a number of ways. Although it had stints of gains, the stock overall during my investment period was negative. I did realize that investing in gold was a lost cause and minimized its weighting in the portfolio, creating a loss minimization. The mistakes that I realized are the fundamentals, Barricks Gold Corp. does not pass Benjamin Graham’s value principles or fundamental analysis. It has long standing debt and negative earnings. A strong dollar does not help the company’s profits either.

Barnes & Noble was also an investment mistake in a very elementary way. I positioned a heavy weighting of Barnes & Noble 2 weeks before earnings, believing a surprise in sales in its online and nook sales. To my surprise Barnes & Noble released a day after my positioning their firm stance in keeping their nook section of their business allowing the stock to move higher on heavy trading. I kept my positioning in the company, not taking any profits on the belief of still being able to profit from an earnings release. This intuition was not correct and instead investors felt Barnes & Noble was overvalued and sold off after the earnings, causing an overall loss for my investment. The lesson I learned is to take profits and adjust targets and investing positioning’s on an agile basis. I should have been sufficient on the gains that came when they released positive news the day before.

Macy’s was a pure miss. I realized this investment was riskier than it needed to be and instead did not profit from what I believed would have been better earnings from the consumer staples. Out of all the retailers I realized Macy’s was on the lower end of expectations compared with others, I felt that retailers could benefit from a lower oil price and due to that intuition and some slight technical analysis I simply positioned myself in the wrong retailer, while other retailers that were on my watch list benefited from their earnings.

Support (Accuracies)

Dollar General reported Q4 earnings on March 12th and I took a large position into Dollar General before earnings release. Dollar General is a discount retailer that has been benefiting on a weak economy, I felt my intuition for Macy’s played a role in Dollar General, although a difference that is key was the fact that Macy’s was a higher end retailer while Dollar General are more discount retailers. The company rose on nice year over year growth according to its earnings and shortly sold my profits, accomplishing my investment objective.

My Greek exchange traded fund has been explained in detail during my analysis section, but in summary, my intuition and following of current events surrounding the Greece elections and bailout situation, I felt an opportunity if carefully timed, could be made to profit on this situation.

Jack in the Box was my first trade that I bought before its earnings report. Again I explained this buy in my analysis section but in short I felt that Jack in the Box was expanding and able to grab a larger market share in the fast-food industry. I completed my investment objective and sold Jack in the Box after the reaction to its earnings release.

Under Armor I bought after a release of consumer goods data that showed a gain throughout the sector and believed Under Armor would benefit from good consumer goods data. CEO Kevin Plank also got publicity by calling out Nike and Adidas, and the short-term publicity and high call/put ratio created a buying opportunity.

Conclusion

In a conclusion of my 2015 Portfolio Management and Security Analysis Investment Project I analyzed and explained my investment strategy, security process, security analysis, and came out with an overall return of 4.6% beating the S&P 500 return of .17% by 4.43%. Although I am pleased with my results, I realize there is much to be learned, better performances I can pursuit by allocating more time to my investment projects. I have also another track record up on my blog Alleyway Investing at http://www.alleywayinvesting.blogspot.com that shows stock watch lists of the year and their returns at the end of the year. I enjoyed this investment project and have planned more for the future.